vehicle personal property tax richmond va

Is more than 50 of. An example provided by the City of Richmond goes like this.

In addition Henrico maintains a personal property tax rate for vehicles of 350 per 100 of assessed value which is the lowest among major localities in the region.

. This is required whether the vehicle is titled in Virginia or in another state or country. 2 days agoHANOVER COUNTY Va. WRIC The Hanover County Board of Supervisors has approved a one-time tax relief plan to lessen the impact of rising personal property values.

The property owner must be at least 65 years of age or determined to be permanently or totally disabled by December 31 st of. Real Estate and Personal Property Taxes Online Payment. Failure to report a vehicle within 60 days will result in a 10 late filing penalty that will be.

At the calculated PPTRA rate of 30 you. Answer the following questions to determine if your vehicle qualifies for personal property tax relief. If your vehicle is valued at 18030 the total tax would be 667.

If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Personal Property taxes are billed annually with a due date.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as. If you can answer YES to any of the following questions your vehicle is considered by. Board of Supervisors Approves 15 Tax Relief on Personal Property Taxes Vehicle values climbed by an average of 33 or more as of Jan 1 2022 according to the JD.

Electronic Check ACHEFT 095. The county also can. Personal Property Tax.

The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for. TAX RELIEF FOR THE ELDERLY AND DISABLED - REAL ESTATE. Parking Violations Online Payment.

Used 2007 Hummer H3 For Sale In Richmond Va With Photos Cargurus

Value Of Used Cars Impacting Personal Property Taxes Vpm

First Half Of 2022 Personal Property Taxes Coming Due In Several

Fairfax County Car Tax Bills To Increase For About 12 Of Vehicle Owners News Center

Youngkin Signs Bill To Reclassify Certain Vehicles And Personal Property Tax Rates Wric Abc 8news

News Flash Chesterfield County Va Civicengage

Value Of Used Cars Impacting Personal Property Taxes Vpm

Henrico Pushes Car Payment Tax Deadline To Aug 5

Hanover Passes 20 Reduction In 2022 Personal Property Tax Bills Wric Abc 8news

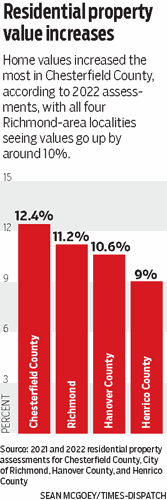

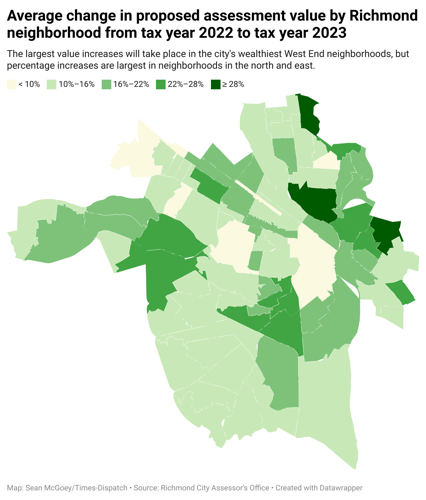

Richmond Sees Another Year Of Double Digit Percentage Increases In Property Tax Assessments

How To Reduce Virginia Income Tax

Richmond Sees Another Year Of Double Digit Percentage Increases In Property Tax Assessments

Virginia Localities Pushing Tax Relief As Car Values Go Up Dcist

615 N 21st St Richmond Va 23223 Realtor Com

Junk Car Removal R R Towing Richmond Va 804 745 8697

2021 Form Va Vsa 14 Fill Online Printable Fillable Blank Pdffiller

Frustrations Rise In Henrico As Personal Property Tax Bills Increase