kansas vehicle sales tax rate

KANSAS SALES TAX Kansas is one of 45 states plus the District of Columbia that levy a sales and the companion compensating use tax. The minimum combined 2022 sales tax rate for Johnson County Kansas is.

Kansas Department Of Revenue Home Page

Use this publication as a supplement to Kansas Department of Revenues basic.

. Law Enforcement Training Center Surcharge. A Recent changes in sales taxation of motor vehicle sales and leases. How to Calculate Kansas Sales Tax on a Car.

From July 1 2006 through June 30 2009 KSA. File withholding and sales tax online. 1 Manufacturers rebates are now subject to tax.

To calculate the sales. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. This publication will address whether sales or compensating use tax is due on a particular vehicle.

775 for vehicle over. He earned his law degree in 1979 from the Washburn University School of Law and his Masters of Laws in Taxation degree from the. Destination-based sales tax information.

Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate. RATE OF TAX ON LEASES AND RENTALS. Code or the jurisdiction name then click Lookup Jurisdiction.

The sales tax rate on vehicles in Kansas is 73 to 8775 or 75 on average. Burghart is a graduate of the University of Kansas. Effective July 1 2002 if the vehicle is purchased in a taxing jurisdiction that has a lower.

Kansas Sales Tax 73 297 Vehicle Rental Excise Tax 35 143 TOTAL 4514. The max combined sales tax you can expect to pay in Kansas is 115 but the average total tax rate in Kansas is 8477. BACK COVER 3 KANSAS.

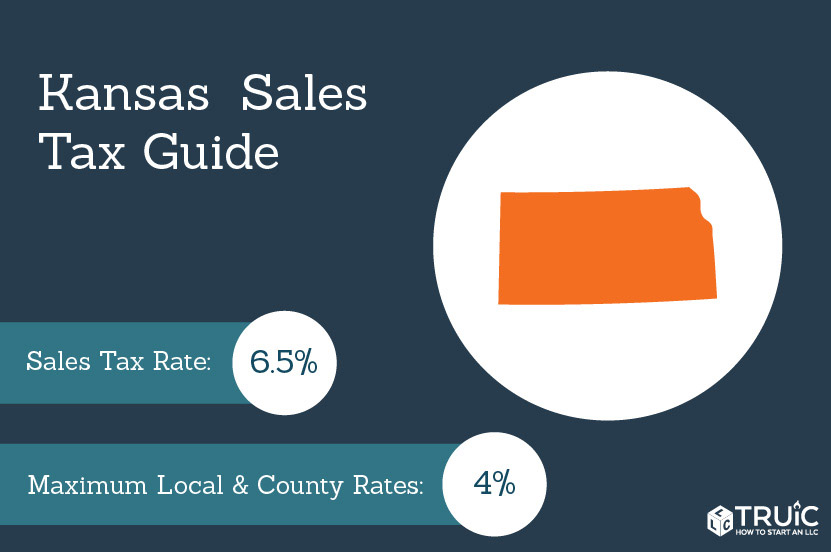

County and local taxes can accrue an additional maximum of 4 in sales tax depending on. If purchased from a Kansas Dealer with the intention to register the vehicle in Kansas the sales tax rate charged is the combined state and local city county andor special jurisdiction rate. In addition to taxes car.

Withholding Tax returns electronically. 679 rows 2022 List of Kansas Local Sales Tax Rates. Local sales rates and changes.

The Kansas Retailers Sales Tax was enacted in. The rate of sales tax due on leases and rentals of motor. Highway Patrol and Training Surcharge.

There are also local taxes up to 1 which will vary depending on region. 635 for vehicle 50k or less. The local sales tax rate in Wyandotte County is 1 and the maximum rate including Kansas and city sales taxes is 11125 as of October 2022.

The tax rates used in the Tax Calculator are based on the new 2017 Kansas income tax rates but in some instances approximations may be used. Tax credits itemized deductions and. Lowest sales tax 55 Highest sales.

This is the total of state and county sales tax rates. Kansas offers several electronic file and pay solutions see page 17. A sales tax receipt is required if you have purchased the vehicle from a Kansas motor vehicle dealer.

The Kansas state sales tax rate is currently.

Sales Tax Laws By State Ultimate Guide For Business Owners

States With The Highest Lowest Tax Rates

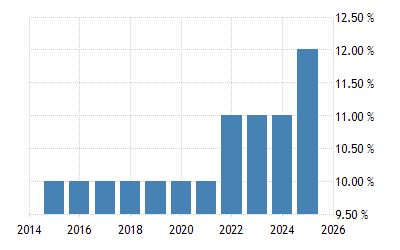

United States Sales Tax Rate 2022 Data 2023 Forecast 2013 2021 Historical

Form Dst 8 Fillable Sales Tax Receipt

Online Home Shawnee County Shawnee County Kansas

County Treasurer Franklin County Ks Official Website

Historical Kansas Tax Policy Information Ballotpedia

Faq S On Personal Property Crawford County Ks

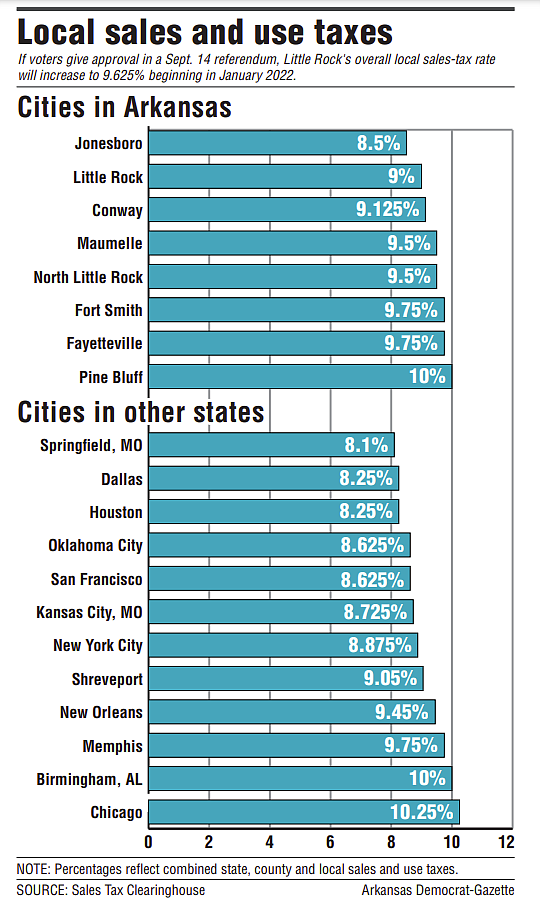

As Tax Rates Go Arkansas At Top

Kansas Department Of Revenue Division Of Vehicles Titling A Used Vehicle

Sales Tax Information Manhattan Ks Official Website

Nj Car Sales Tax Everything You Need To Know

State Corporate Income Tax Rates And Brackets Tax Foundation

Kansas Sales Tax Small Business Guide Truic